" Hence, although the intention of the subsidy may be to reduce the price to the consumer by the full amount of the subsidy, the producer gets some of the benefit in terms of extra revenue that they can keep."

https://www.economicsonline.co.uk/competitive_markets/subsidies.html/

Subsidies

A subsidy is an amount of money given directly to firms by the government to encourage production and consumption. A unit subsidy is a specific sum per unit produced which is given to the producer.

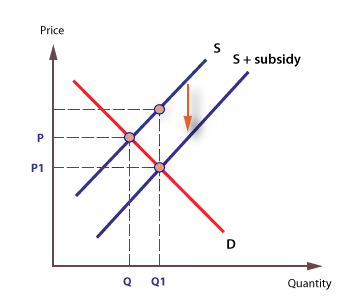

The effect of a specific per unit subsidy is to shift the supply curve vertically downwards by the amount of the subsidy. In this case the new supply curve will be parallel to the original. Depending on elasticity of demand, the effect is to reduce price and increase output.

The incidence of a subsidy

The economic incidence of a subsidy indicates who is made better off by the subsidy. In contrast, the legal incidence indicates who, by law, the subsidy is intended to help. In the diagram below, the subsidy per unit is A – B, and the new quantity consumed is Q1.

However, the price the consumer pays does not fall by the full amount of the subsidy – instead it falls from P to P1. Hence, although the intention of the subsidy may be to reduce the price to the consumer by the full amount of the subsidy, the producer gets some of the benefit in terms of extra revenue that they can keep. The gain to the consumer is P – P1 per unit, and the whole gain to the consumer is the area PFBP1.

The gain to the producer is C – P per unit and the total gain to the producer is CAFP. The overall cost of the subsidy to the government is the area, CABP1.

No comments:

Post a Comment